Looking back at the trends in Web3, 2020 was the year of DeFi, 2021 was the year of NFT and crypto games, and 2022 will see a more significant focus on DAO.

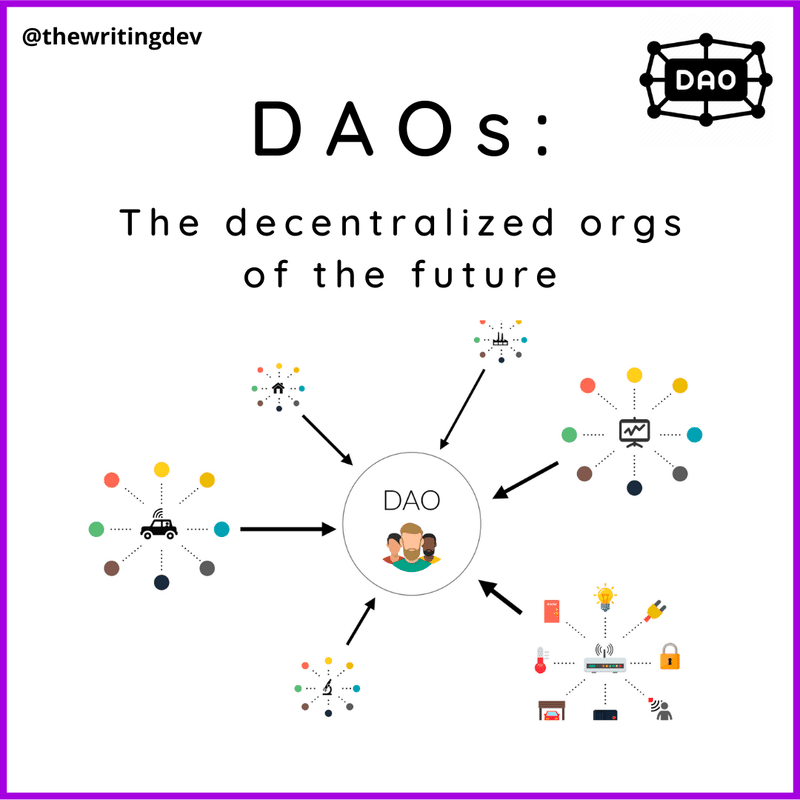

DAO stands for "Decentralized Autonomous Organization." In simple terms, it is like a company without a president.

A DAO is an organization in which the members autonomously provide value and promote the business toward realizing the mission, without managers such as shareholders, executives, or directors.

The most famous DAO is the Bitcoin project.

Thanks to the contributions of miners around the world, Bitcoin has grown to a market capitalization of nearly 872.4 Billion dollars.

The DAO has core developers (contributors) who set the project's direction. The members of the DAO vote on the choices presented by the contributors to move things forward.

I will explain why DAO are attracting so much attention in this post. Then I will delve into the case studies of DAO, how they work, and their possibilities and challenges.

- We've gone from users to stakeholders

- Holding them is a stakeholder in the project.

Features and challenges of DAO

- Decentralized organization with no administrator

- A highly transparent organization in which everyone can participate

- Challenges of DAO

The primary genre centered on the typical DAO

- Friends with Benefits (FWB)

- FORE FRONT

- Uniswap

- Flamingo DAO

- Gitcoin

- RaidGuild

Why DAO now?

Looking at the history of the Internet so far, I can say that DAO is an inevitable trend.

Let me briefly explain why.

We've gone from users to stakeholders.

Before looking at the future where DAO will become the norm, let's first look back at the Web's past.

Here are a few examples that come up often.

Web1: Companies provide content to users

First of all, in the 1990s and 2000s, known as "Web 1", the Internet was a one-way street where we consumed the content delivered by companies.

Yahoo! and Google are the representative companies in this area.

Web2: Users provide the content

Since 2000, Web2 has become more interactive with its improved infrastructure, allowing users to upload content easily.

The users themselves became the content providers, and the companies became the platforms that became the "places" for the content.

Social networking companies such as Facebook, Twitter, YouTube, TikTok, etc., attract vast traffic.

Web3: Users provide the platform

It is what the headline means when it says, "Users become stakeholders.

Most of the online content we spend a lot of time on is UGC (User Generated Content). We are already part of its operation.

In this way, users contribute a great deal to the platform, but they are not getting much in financial return.

It is a problem that is becoming more and more apparent.

Since 2015, when this issue became apparent, blockchain technology has snowballed, allowing users to "own" digital content and design incentives for its use (smart contracts).

It has enabled many blockchain projects to motivate early users and developers to own "tokens," the Web3 version of shares, and contribute to increasing their value.

While there are still some centralized projects, we can see that there is a lot of allocation to the community.

For example, Mr. Vitalik, the founder of Ethereum, a blockchain app development platform, has had a few percent of the company from the beginning, which is the opposite of the current concept of stock in a corporation.

Owning a cryptocurrency means participating in a DAO.

In other words, the cryptocurrencies such as Bitcoin, Ethereum, Tether, Solana, etc., that you are familiar with in this are not really "currencies" but "tokens" of projects/companies.

Holding them is a stakeholder in the project.

Due to the name "cryptocurrency" and its volatility, people focus only on the price.

Still, these tokens are essentially tokens to reward contributors to the project.

In other words, if you own a particular cryptocurrency, you are participating in the DAO.

Suppose the value of the cryptocurrency (token) you own rises. In that case, there is a financial benefit where the motivation to promote the project arises.

But what about DAO tokens, which are still a few dozen to a few hundred people's projects? Suppose no one else is aware of its future value, and you are the only one who sees the potential.

In that case, the token has unlimited growth potential.

Features and challenges of DAO

I told you that DAO is getting a lot of attention because we are both users and owners of the service.

We can get significant financial returns from our active contribution to it.

I hope you feel that the trend of DAO is coming as the next trend after the current trend of Web3 technology and the increasing number of millionaires from startups. In this chapter, I will explain the features of DAO.

Decentralized organization with no administrator

As the word DAO implies, there is no president or leader, and ownership is distributed through tokens according to the people participating in the project, including developers, partners, and users.

The DAO mission is realized daily according to its own pre-programmed rules on the blockchain.

This program works autonomously by incentive design.

During the program period, any changes to the program will be proposed and voted on by the token holders, and DAO will make updates flexibly.

There are also governance tokens that can be used as voting rights.

Both DAO and traditional stock companies do the same thing: they provide a service or product to the market and get paid for it.

The proceeds are put into a DAO account called Treasury.

The proceeds are distributed based on the smart contract rules and the voting process.

As DAO becomes the norm, there will be two types of DAO

- the organization itself will become a DAO.

- There will be a conventional company organization, and each project will become a DAO.

A highly transparent organization in which everyone can participate

Along with decentralization, another prominent feature is transparency. Since the blockchain manages intelligent contracts, basically anyone can see the program. Its communication is usually open to the public.

Community management is often done on Discrod, and the conversations there can be viewed and tracked by anyone.

In other words, all internal discussions and emails are open to the public, which is the exact opposite of the Web2 concept of monopoly and technological superiority.

It is an organization that embodies the concept of blockchain, which allows secure transactions without the need for cumbersome procedures because trust is guaranteed.

So if you're thinking of contributing to a DAO or buying tokens, you can check out what's going on in a potential Discord community to see if you should bet on it.

This kind of open and giving stance, including the concept of composability, is a characteristic of Web3, and I feel strongly about it.

The DAO, which requires a Copernican shift from Web2, is a complicated management method for established companies to accept.

We may find ourselves in a state of boiling frogs, losing customers to Web3 companies operated by DAO.

The DAO is an organization whose stakeholders function at an unprecedentedly fluid level.

In the past, economies developed from where property rights were guaranteed, and the cost of exchange was low.

Still, with the DAO, a genuinely smooth society will arrive.

Challenges for DAO

Although I have only reported on the positive aspects of DAO, it is still in its infancy, and there are many more challenges.

As an autonomous and transparent organization, DAO is still in a phase that needs to be improved in terms of security, including social engineering.

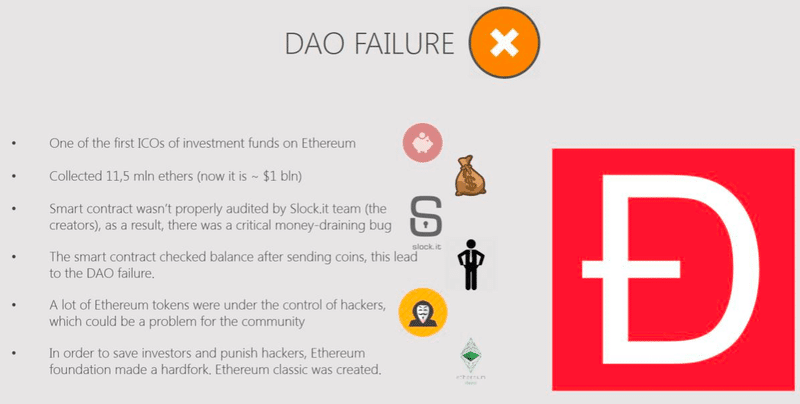

1. Security issues

One of the most famous and common-sense cases is the hacking of $150 million worth of data collected from "The DAO" in June 2016 (at that time!). The DAO is a community of Ethereum.

DAO was a project in which members of the Ethereum community pooled their money to create an investment fund and profit. Still, there was an incident in which 1/3 of the money raised was extracted, and a hard fork was done.

As a result, a hard fork was conducted to extinguish the incident.

And since then, the cryptocurrency Ethereum Classic and many other projects have been born, but vulnerability is still an issue.

Also, a small number of members with many governance tokens can collude to steer the DAO in a beneficial direction rather than in the community's interest as a whole.

It leads to the problem of collaboration in governance.

The problem of fair voting, which is, in fact, a sham, is an urgent issue that needs to be resolved by 2022.

2. Complex operational issues

Another more practical issue is the business operations on DAO. The DAO is not suitable for sales, customer support, marketing, and business development that require negotiations with partners.

It is not ideal for marketing or business development that involves negotiation with sales, customer support, or partners. It is also not suitable for local projects, as communication in English is fundamental to its premise.

It will probably be a while before DAO replaces the highly individualistic work done by ad agencies and salespeople.

On the other hand, DAO is suitable for simple tasks in operation and scale globally.

With this in mind, it makes sense that many of the most successful DAO today are in the DeFi (distributed finance) space.

It is an area with a global need where growth can be achieved through program improvements such as fees and interest rate parameters, which may be a good target in the short term.

For example, MakerDAO, a representative of the DeFi project, is mainly engaged in loan intermediation.

DAI, a staple coin issued by MakerDAO, is approximately 38,388,050,800.00 dollars in circulation.

3. Evaluation of competitiveness and disparity within the DAO

Measuring and rewarding all contributions will lead to a more meritocratic allocation of resources, leading to an extensive evaluation and reward bias.

Contributions that do not show up in numbers cannot be evaluated well.

4. Cognitive overload

There is a saying that the number of DAO bars is not the same as that of Dan bars.

Still, people's time is finite, and their attention is limited, so there is a limit to the number of DAO they can participate in.

5. Short-term speculative non-connectivity problem

It is another issue that we feel is a big problem. We foresee that many users will only work for short-term financial incentives to acquire tokens.

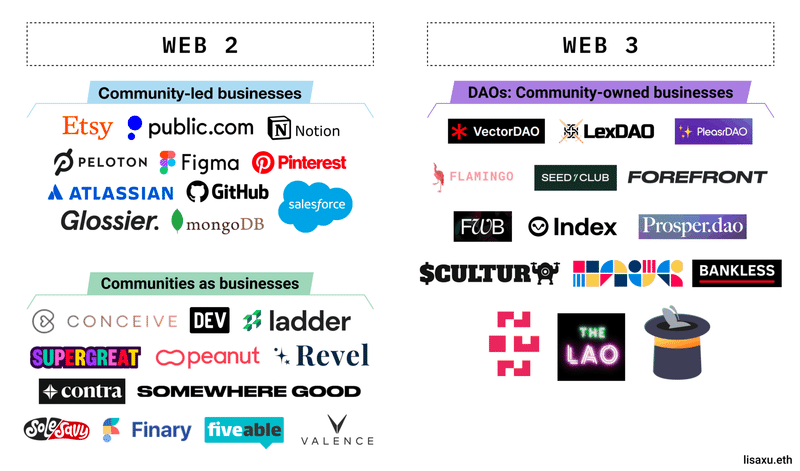

The primary genre centered on the typical DAO

In addition to the MakerDAO, there are many other types.

Let's take a look at some of the most popular DAO.

Friends with Benefits (FWB)

FWB is a DAO invested in by a16z, so it is often a representative example of a DAO.

A DAO advocates a "digital city" and a social community DAO to create a cultural movement.

It is a DAO for DAO, with various activities that transcend online and offline boundaries. It is a spin-off of a project to support creators.

In a sense, it is a gateway to the Web3 renaissance, and I can't help but be amazed at the foresight of a16z, which took notice of this and invested 8,724,557.00 dollars.

Incidentally, to join FWB, you need to hold $75 worth of FWB tokens.

This kind of socially oriented DAO is classified as "Social DAO," Other famous ones are Seed Club, CabinDAO, Bright Moments, etc.

Seed Club is a spin-out DAO of FWB and supports FORE FRONT, which I will introduce next.

FORE FRONT

FORE FRONT is a DAO classified as a "Media DAO," As its name suggests, it is an aggregation site for Web3-related content.

It is the DAO version of online media. The tagline "A digital hub that unlocks endless paths and avenues to the creative playground of Web3" is pretty cool too.

If you provide good content (submit it through the Discord channel) and get approved by stakeholders, it will be FEATURED on the top page, and you can get FF tokens.

The DAO is also raising funds and is actively looking for core members.

I think it's easy to understand the concept of FORE FRONT, where anyone can get rewarded for providing the content.

There are also other DAO in this space, Bankless, and DarkStar.

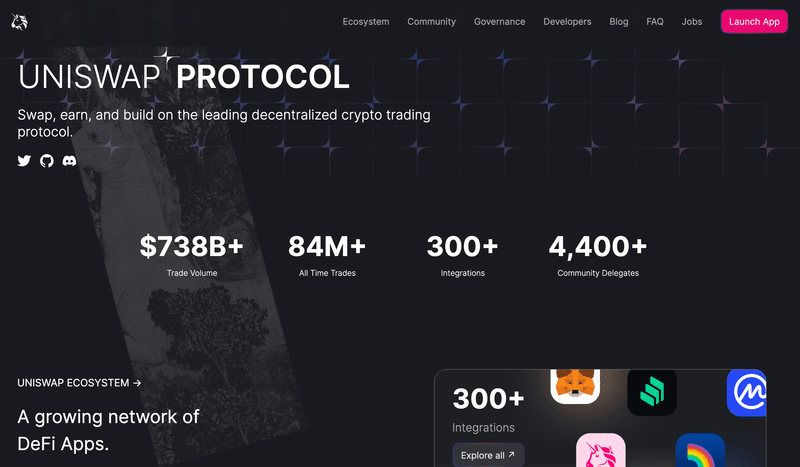

Uniswap

The most mature DAO are the "Protocol DAO" represented by Uniswap, Sushiswap, Compund, and DeFi, such as MakerDAO.

All of these are equally well known.

As the name of the protocol suggests, they are DAO that have developed mainly around the DeFi Protocol group.

It is the most mature genre of DAO.

It can be said that it is the DAO that has led the DeFi Summer, with the distribution of governance tokens as incentives for contributions and marketing methods such as airdrops.

This area has the most significant number of genres.

Outside of the DeFi area, Audius and Ocean DAO can also be mentioned.

It is also the area closest to Bitcoin and Ethereum, which can be said to be the final form of DAO.

As mentioned above, it is a DAO that frequently appears in financial areas where operations are simple, and there is a global need.

It is recommended that you join one of these communities.

Flamingo DAO

The Flamingo DAO is a DAO that specializes in the joint purchase of NFTs.

The purpose of the Flamingo DAO is to purchase expensive NFTs that cannot be purchased by a single person as an investment product and to earn a return on the increased value of the NFTs.

Like existing DAO, Flamingo's DAO is classified as an "investment DAO," a for-profit investment in the project.

It has a return-driven objective that is easy to understand and attracts funds.

It has the potential to have a significant impact on the industry.

The most influential Flamingo Dao will be the following

- Constitution DAO" for the purchase of the original US Constitution

- Blockbuster DAO" for the purchase of Blockbuster

- Krause House DAO for the purchase of an NBA team

- Links DAO" for the purchase of a golf course

Other traditional players include TheLAO, PartyDAO, GenesisDAO, MetaCartel Venture, etc.

Gitcoin

Unlike the Investment DAO, Gitcoin is a "Grant DAO" where members contribute funds on the premise of donations rather than aiming for returns.

Gitcoin is a famous DAO for supporting open source developers and fostering communities.

Like the Moloch DAO, it's a Web3 version of a DAO that contributes to developing a better internet industry without giving anything in return.

As with Moloch DAO, it's more like a Web3 version of UNICEF that contributes to creating a better internet industry without any return.

Recently, many DAO have been attached to existing projects and function as revitalizing the parent community.

Like Uniswap's Uniswap Grants, Compound and Audius are also working on such initiatives.

RaidGuild

A DAO doesn't just work by creating a mission and launching a Dicord server. Like a traditional company, you need members, and especially in the early stages, you need a lot of calories.

Several "ServiceDAO" communities have sprung up to support the operation of such DAO (think pickaxe/jean shop in the gold rush), and one of the most prominent of these is RaidGuild.

This is the DAO version of a contract production company, functioning as a service to supply Web3 talent.

Members are typically community members that can provide services to external clients or do internal operational work for DAO.

There is no doubt that members of such communities will lead the Web3 trend in the future.

Other " ServiceDAO " include DAOhaus, LexDAO, and YAPDAO.

The following post will cover the setup and operation of the DAO.